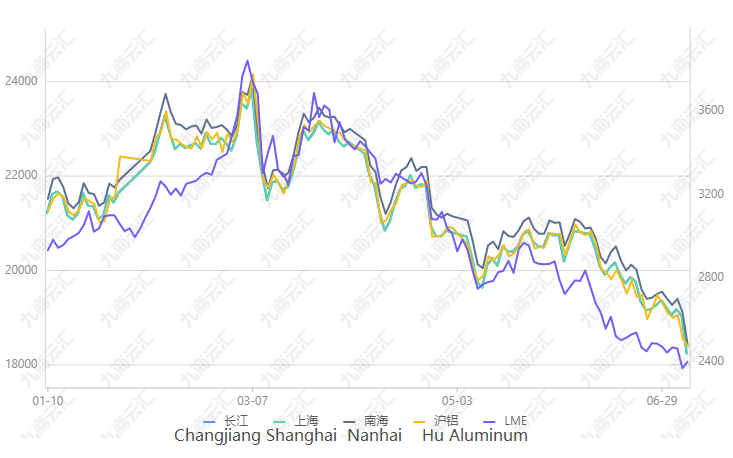

At present, the global macro pressure demand for aluminum is expected to weaken. Based on the policy differentiation at home and abroad, it is expected that Shanghai aluminum will continue to be relatively stronger than Lun aluminum. In terms of fundamentals, the expectation of continued supply has increased, and the marginal increase in demand has weakened. On Monday, the aluminum ingot stock was flat compared with last thursday, and the aluminum rod stock was 2,300 tons compared with last thursday. The delivery volume of aluminum ingots and aluminum rods was reduced compared with last week. In terms of cost, the increase of enterprises’ domestic loss will not affect the production increasing expectation for the time being, and focus on the progress of investment and resumption of production in Guangxi; Overseas, European natural gas supply worries is strengthening, it may be driving up electricity prices, threatening aluminum plants to further reduce production.

To sum up, the transaction logic is under macro pressure and the demand is weak, the domestic and foreign aluminum prices are still going down, but the cost and overseas low inventory problems need to be vigilant. In addition, we are concerned about whether the rapid decline of commodities will cause the fed to raise interest rates in July less than expected.

Post time: Jul-07-2022