Global aluminum prices stabilize but remain a downside risk as demand remains weak

By Ruiqifeng Aluminum at www.aluminum-artist.com

After a sharp decline throughout September, aluminum prices appear to have performed strongly this month compared to other metals. Aluminum prices bottomed at the end of September, but rebounded in the first week of October. If prices continue to break out of the upper range, this would indicate that prices will rise and the downtrend will stop. However, despite the recent rebound, the momentum of the longer-term macro downtrend will continue to add pressure to the index.

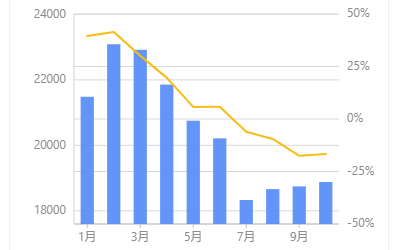

The Monthly Metal Index (MMI) for aluminum fell 8.04% from September to October, with all components down.

Global physical delivery premiums continue to decline from their respective peaks, and these premiums remain an accurate measure of primary aluminum supply relative to demand. As a result, the decline in premiums implies a reduction in demand.

Aluminum buyers in Japan reportedly recently agreed to pay a premium of $99 per ton for October through December shipments. This is below the initial offer made by producers for aluminum prices, which ranged from $115 to $133 per ton. This would mark the fourth consecutive quarterly decline for the industry. In fact, the current price is 33 percent lower than the $148 per ton paid between July and September, and down 55 percent from the peak of $220 per ton set in the fourth quarter of 2021. As Asia's largest aluminum importer, the premium negotiated by Japan will serve as a benchmark for the entire region. More recently, Asian demand appears to be more resilient than Western Europe. However, quarterly premiums at Japanese ports continue to fall, suggesting that demand is falling there as well.

Meanwhile, European outstanding tariff premiums peaked later than in Japan, reaching $505 per ton in May. Nonetheless, the premium has fallen by 50% and is now resting above $250 per tonne.

Midwest premiums have also been declining since the end of March. After peaking above $865 per tonne, the premium has largely steadily declined to its current level, down 44%. This is the lowest level since May 2021 at just over $480 per tonne.

Global primary aluminum production is still growing as demand tends to soften. According to the International Aluminium Association, production rose for the third consecutive month in August, with global output increasing to 5.888 million tons, with Asia alone accounting for nearly 60 percent of that total. In fact, the continued increase in Asian production has helped bolster supply at a time when production in regions such as Western and Central Europe is facing increasing constraints.

Meanwhile, global manufacturing paints an increasingly grim picture. In Asia, constrained by the epidemic, the manufacturing PMI fell further into contraction territory to 48.1 in September. the eurozone manufacturing PMI was 48.4, down for the seventh consecutive month and the third consecutive month of contraction. Meanwhile, the U.S. ISM manufacturing PMI and Japan manufacturing PMI maintained growth at 50.9 and 50.8, respectively. September was the sixth consecutive month of decline for the Japanese and U.S. economies as economic growth continued to slow. Factory activity in each region came under downward pressure as demand declined.

This is partly due to increasing weakness in the manufacturing sector and a continued decline in demand. At the same time, the market is now increasingly oversupplied. This collective impact could mean that the macro downward trend in prices and premiums will continue in the coming months. If the U.S. and Japan can sustain growth, and the rest of Asia can change its epidemic clearing, this could strongly offset other pessimistic trends.

For more information of aluminum, please visit www.aluminum-artist.com

Post time: Oct-12-2022